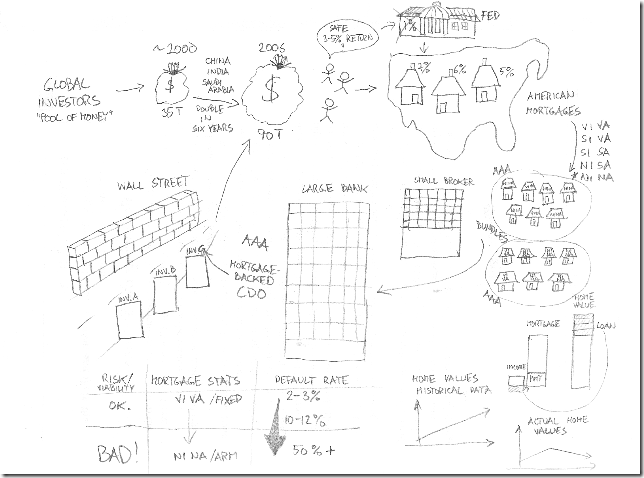

If you haven’t heard the two NPR stories on the current economic crisis yet, it’s worth going out to listen at www.thislife.org: The Giant Pool of Money and Another Frightening Show About the Economy (or read through the two transcripts). After listening to the first one, I was inspired to try to illustrate the whole thing and sketched this down in about 45 minutes or so:

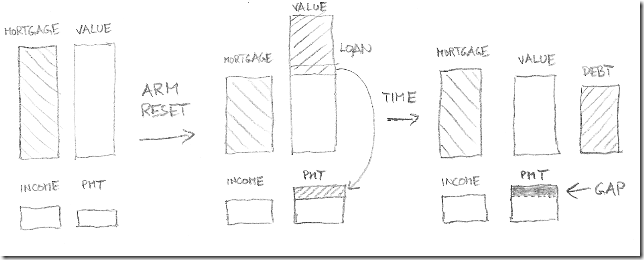

Part of the meltdown was the ARM mortgage reset:

At the beginning, the income covers the payment. At the reset, the payment becomes bigger (unfortunately), the income is the same and doesn’t cover the payment. Because of higher home value, a loan can be taken out to cover the gap in payment. Over time that loan becomes pure debt. When there is no more of the loan left, the only way out is selling the house. At that point, the value of the house has dropped and is below the amount of the mortgage. In addition there’s now another pile of debt to pay off. The result: great Pain.

I’ve since then learned that someone did a much better job of visualizing the story, using animation and wonderful design. That someone is Jonathan Jarvis, and the illustration is at www.crisisofcredit.com. Worth seeing.

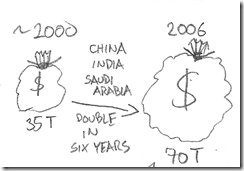

The one thing that I don’t think anybody is shining a light on, however, is this part of my own drawing:

If indeed the whole thing starts with the Global Pool of Money doubling in about six years, and that money was “looking” for a safe return of three to five percent, then isn’t the crisis just as much to blame on what caused the doubling of the Pool? According to the NPR show transcript (PDF)

How’s the world get twice as much money to invest? Lots of

things happened, but the main headline is all sorts of poor countries became kind of

rich making TVs and selling us oil: China, India, Abu Dhabi, Saudi Arabia. Made a lot

of money and banked it. China, for example, has over a trillion dollars in its central

bank, and there are office buildings in Beijing filled with math geniuses-real math

geniuses-looking for a place to invest it. And the world was not ready for all this

money. There’s twice as much money looking for investments, but there are not

twice as many good investments.

The keywords here are “making TVs and selling us oil”. TVs of course stand for everything that no longer is made in the U.S.: toys, computers, radios, cars, you name it. So not only did the “highly inventive” American banking system contribute to the collapse, regular consumers actually kicked the whole thing off, in a way, with an enormous appetite for cheap consumer goods. Food for thought, I would say.

I’d like NPR to do a story on that doubling of the global Pool of Money. Would go right with my little bent for “voluntary simplicity”, which I haven’t really written about in a long time. If we all weren’t chasing the dream of bigger – faster – more, maybe we wouldn’t be hurting so much right now. Maybe we’ll learn about the value of “enough”. Check out the links in the sidebar for plenty of reading on the subject of “enough” and “voluntary simplicity”. It’s something I struggle with every day.